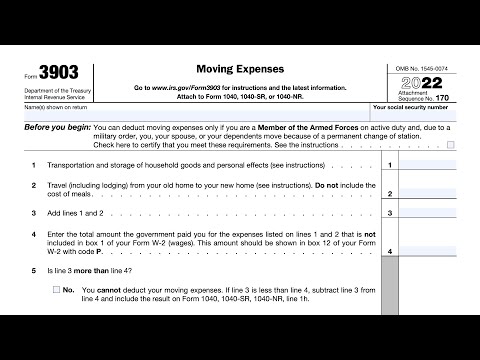

This video we'll be going over IRS form 3903 moving expenses now this is a fairly straightforward tax form after the tax cuts and jobs Act of 2025 beginning in tax year 2025 the moving expense deduction was largely eliminated for most taxpayers and the primary exception would be for members of the Armed Forces on active duty uh due to military permanent change of station orders known as PCS orders so this could be for the taxpayer the service member it could be a spouse or for dependents and uh that's the the primary taxpayer category that is still able to deduct certain moving expenses for from their taxable income now as thank you I guess a precursor people that are going to use this form should know that you can't deduct expenses uh for household goods moves that were incurred by the government in other words you can't get a tax deduction on PCS moves that were reimbursed when you do your PCS travel voucher or for you know a do-it-yourself move in which the military paid you to move some of your household goods so this is this form is only to claim an expense deduction for unreimbursed expenses that you might not have been entitled to during your duty station move so now if you are a spouse or the dependent of a armed services member who is either a deserter goes to jail or dies on active duty then you can still use this as a spouse or dependent to move to either the your home of record your service members home of record a closer point to the United States or the place Of Enlistment um so you can deduct expenses that were not reimbursed for either travel or moving household goods and personal...

Award-winning PDF software

How to prepare Form 3903

About Form 3903

Form 3903, also known as the Moving Expenses form, is used by individuals who incurred moving expenses related to a job change or relocation. This form is filed by taxpayers who are eligible to deduct their moving expenses as an adjustment to their gross income. To qualify, the taxpayer must meet certain requirements including the distance of the move and the time employed after the relocation. It is important to note that only certain moving expenses are deductible, such as transportation costs and packing materials, and there are limits to how much can be deducted.

What Is Form 3903?

Online technologies help you to arrange your document management and enhance the productivity of your workflow. Follow the quick tutorial as a way to fill out Irs Form 3903, stay away from mistakes and furnish it in a timely way:

How to fill out a Irs Form 3903 2014?

-

On the website containing the document, choose Start Now and pass towards the editor.

-

Use the clues to complete the applicable fields.

-

Include your individual details and contact details.

-

Make absolutely sure that you enter appropriate data and numbers in appropriate fields.

-

Carefully review the written content of the form as well as grammar and spelling.

-

Refer to Help section when you have any concerns or contact our Support staff.

-

Put an digital signature on your Form 3903 printable using the assistance of Sign Tool.

-

Once blank is completed, click Done.

-

Distribute the prepared document by using electronic mail or fax, print it out or save on your gadget.

PDF editor enables you to make changes in your Form 3903 Fill Online from any internet connected device, customize it based on your needs, sign it electronically and distribute in different means.

What people say about us

How you can fill out templates without having mistakes

Video instructions and help with filling out and completing Form 3903